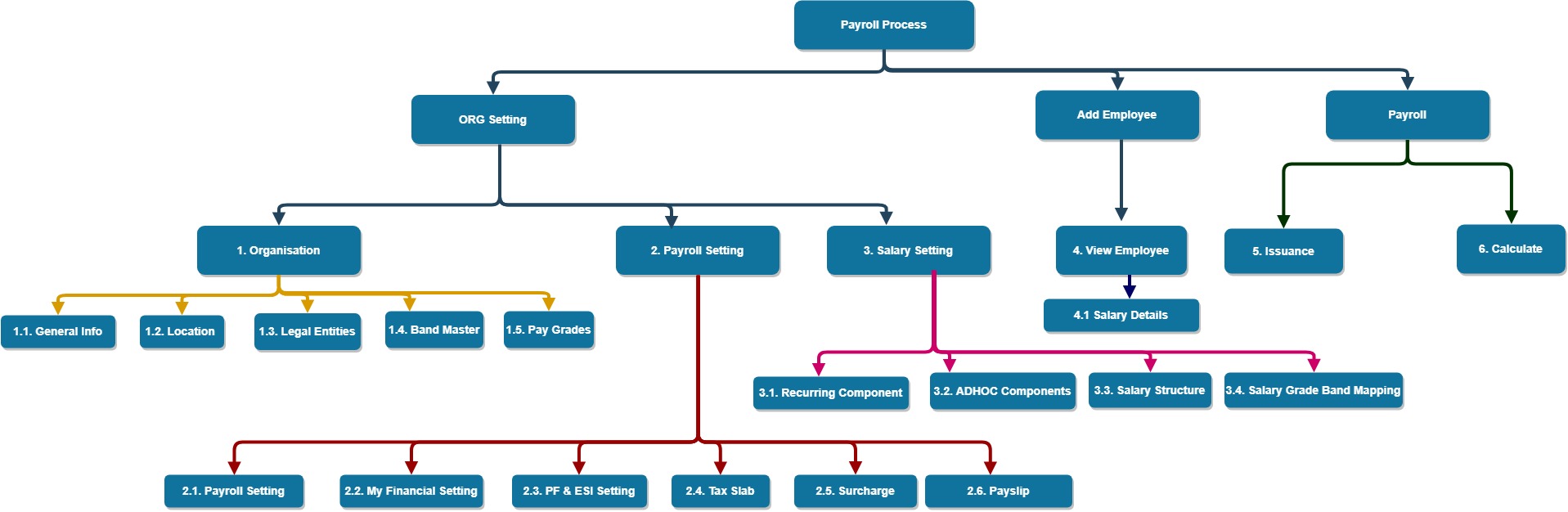

Processing of salaries involves critical tasks and demands accuracy at the same time. The system has been designed with reputed and practicing Chartered Accountants along with HR Professionals who understand the various complexity levels and have an experience that expands over the decades.

Our Payroll Processing features include:

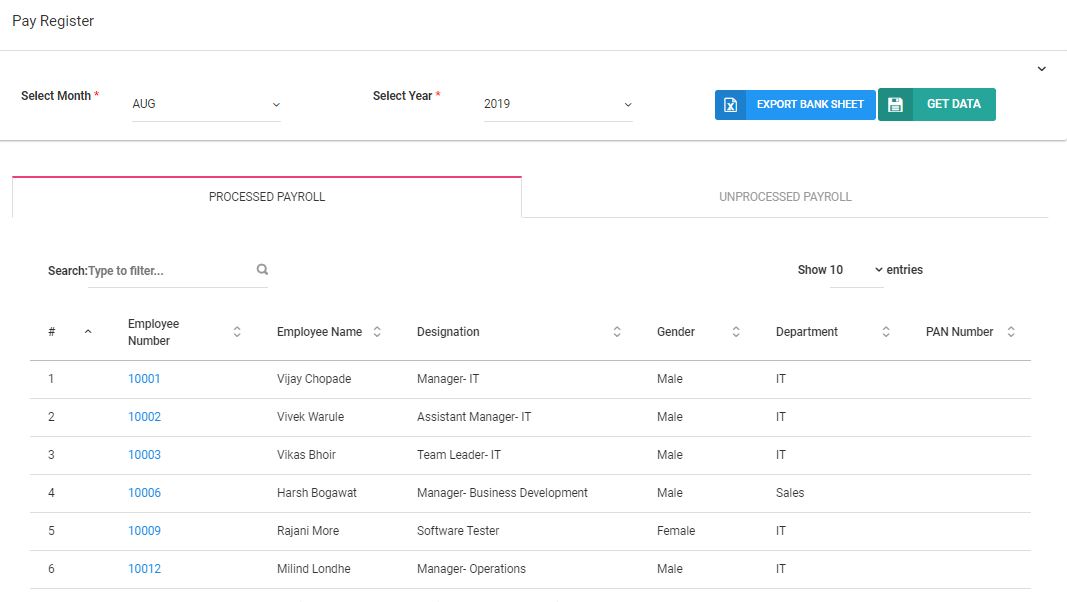

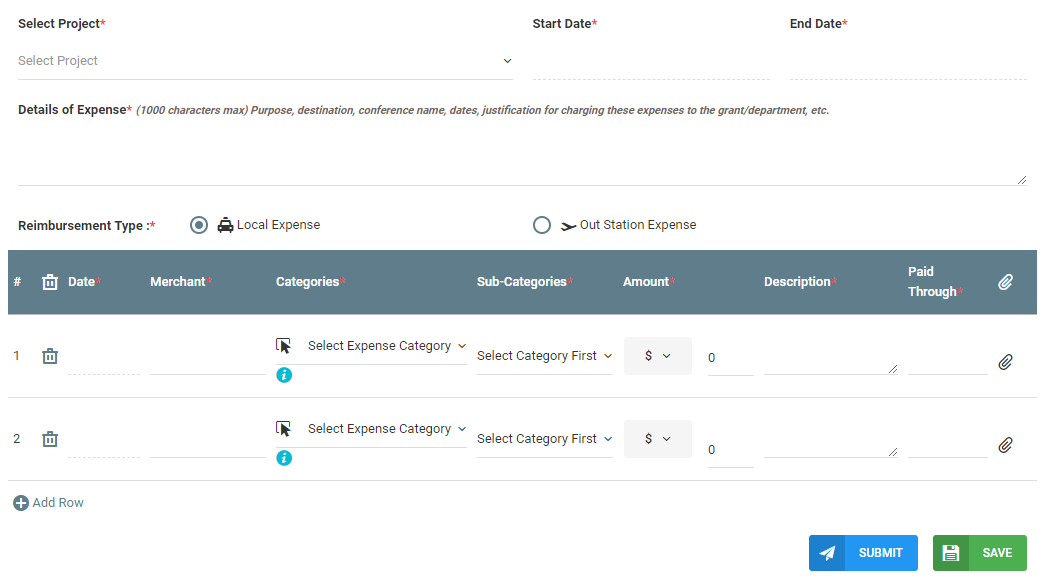

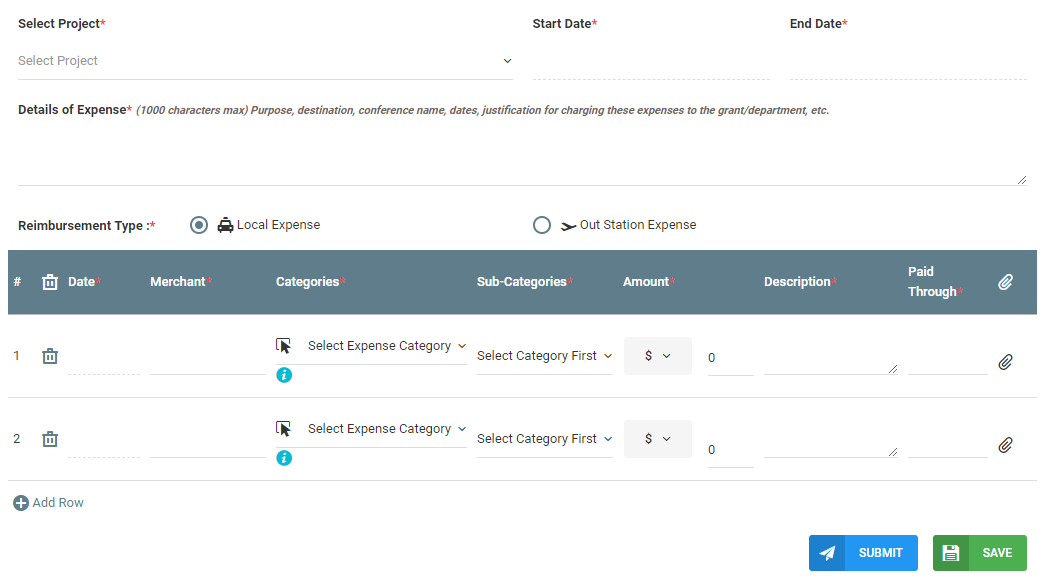

Accurate processing of financial records like salaries, wages bonuses, deductions and much more.

Integrated with attendance management and gamification.

Includes state-of-the-art UI that simplifies and de-jargonises the entire user experience.

Track changes to the system and takes back up of various components threshold.

TalenTicks and MEETCS can help you get started with their interconnected team of HR Professionals and industry experts. Have a few answers ready and we’ll be on our way:

Do you want HR services in addition to payroll?

What industry-specific needs does your business have?